Is An Annuity Right For You?

“As money managers and fiduciaries, our job is to solve for our clients’ unique financial needs. When used appropriately, and coupled with proper financial planning, one of the many types of annuities can go a long way to helping secure your retirement situation.” - Richard Heckard, CPA

What Can Different Types of Annuities Solve For?

-

Guaranteed Lifetime Income

Recent studies have shown that under 20% of Americans believe they will not have enough income in retirement to be comfortable. When used with specific financial planning, having an annuity assist in guaranteeing a portion of your income in retirement can be incredibly helpful.

-

Hedged Asset Growth

In a low interest rate word, everyone is seeking ways to generate return. While those in or approaching retirement may have a lower risk tolerance than some, they still need some growth opportunity. There are annuities that offer growth potential with downside hedges and buffers.

-

Principal Protection & Fixed Return

If your risk tolerance is relatively low, or your financial situation requires stability of your principal, there are annuity options with guaranteed returns with no risk of loss in down markets.

-

Tax Deferred Growth

If your investment is with after tax dollars, also called non-qualified, annuities provide the opportunity for your dollars to grow and accumulate tax deferred, which is more advantageous than simple brokerage accounts.

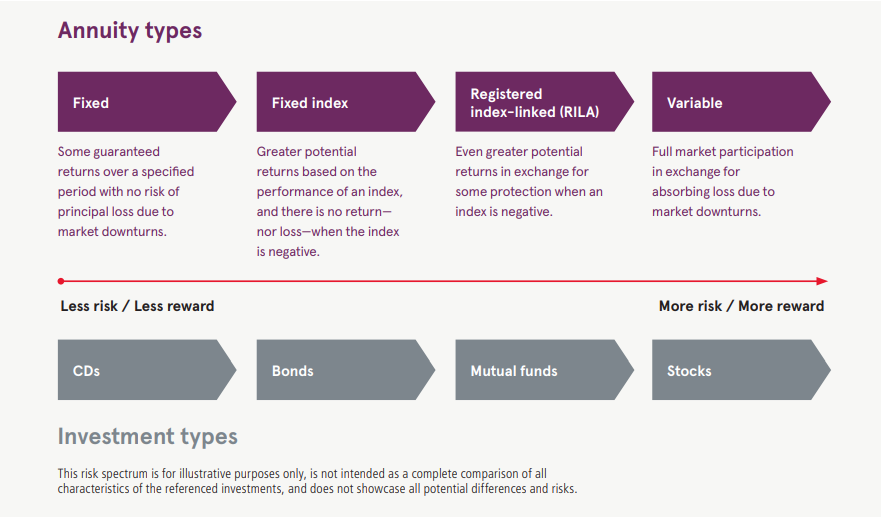

Understand Your Risk

The type of annuity you may need comes down to many important financial planning concepts, including risk tolerance. From fixed contracts with principal protection, to variable contracts with growth exposure, there are many options available. This chart helps explain different types of annuities, their relative features, and their risk and reward scenarios.